The retirement of capital credits—so-called because members provide capital to the cooperative for it to operate and expand—depends on the co-op’s financial status. Eastern Illini holds onto allocated capital credits to cover emergencies, such as a natural disaster, and other unexpected events, and to expand our electric system, all of which may require large-scale construction of poles and wires. By holding on to the capital credit allocations, we can lessen or eliminate the need to raise rates or borrow money (which could also lead to higher rates) to pay for the infrastructure. Each year, Eastern Illini’s Board of Directors carefully looks at the financial condition of our cooperative to determine how much, if any, capital credits can be retired.

Eastern Illini’s President/CEO Bob Hunzinger noted, “The cooperative business model is special for many reasons, but one of the main ones is capital credits. The financial stake that you, and all of our previous member/owners, have, really makes this your cooperative. We are fortunate that our financial condition allows us to return this portion of our members’ equity investment.”

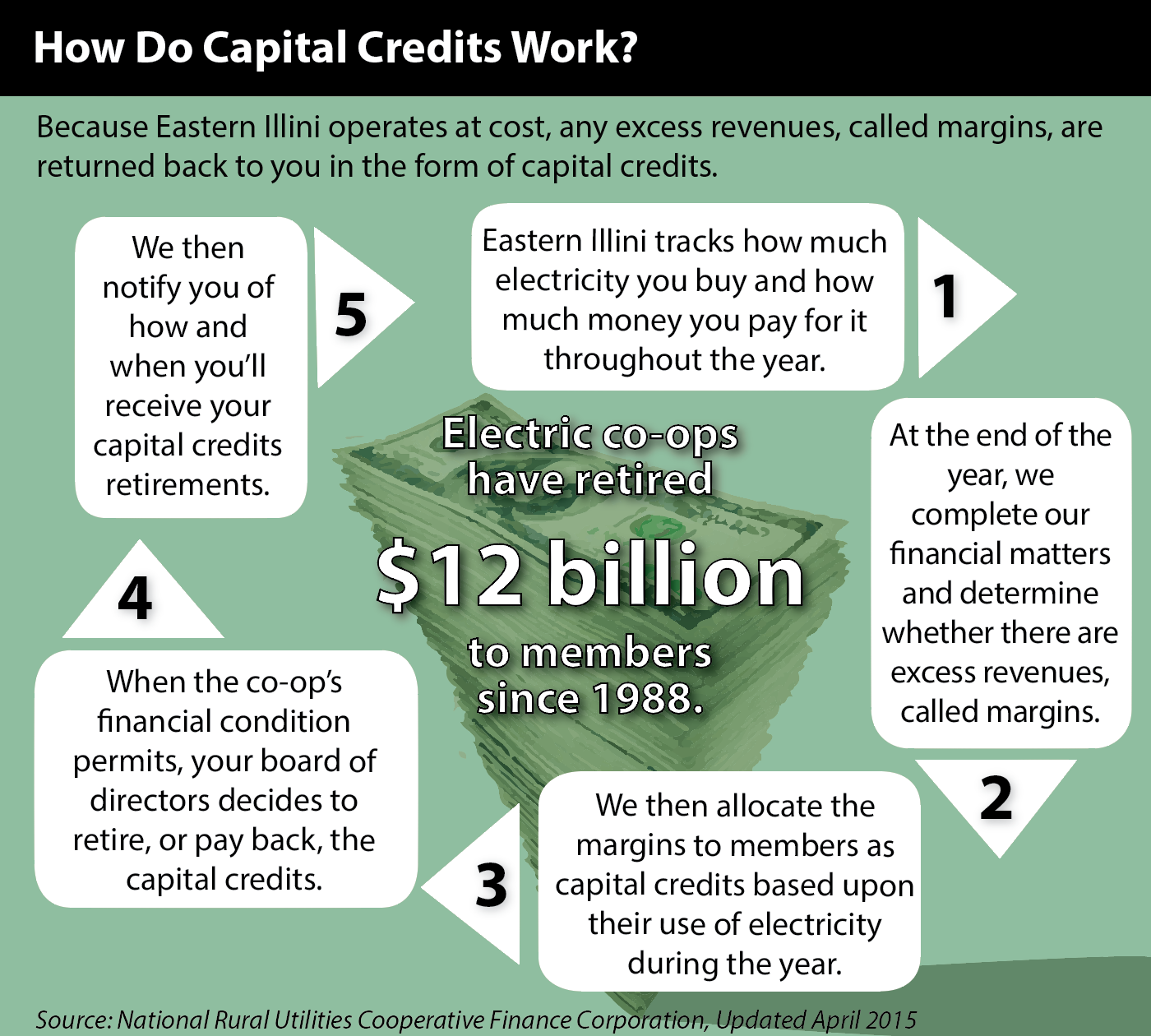

Since 1988, co-ops have retired over $12 billion, based on data from the federal Rural Utilities Service and the National Rural Utilities Cooperative Finance Corporation (CFC), the premier private market lender to electric cooperatives.

“Margins earned from electric revenues are the only real source of equity for not-for-profit electric cooperatives,” says Rich Larochelle, CFC senior vice president, corporate relations. “Investors in CFC look to the underlying financial strength of our member electric co-ops—and strong and consistent equity levels are one key aspect of financial strength. So it’s essential for a co-op to maintain the right balance between retiring capital credits to members and retaining sufficient equity on its balance sheet.”

He adds, “Co-ops do a good job of striking that balance. That contributes to CFC’s ability to offer attractive rates on loans to co-ops, which in turn helps to keep their costs low.”

“Retiring capital credits is just one more way Eastern Illini is looking out for you,” emphasizes Hunzinger.